What is AscendEX?

AscendEX launched on 22 March 2021 in Singapore, after renaming from BitMax.

Currently, AscendEX offers trading in a decent number of cryptocurrencies. All of the largest ones are available here, the platform supports over 190 trading pairs and 40 different margin trading pairs.

AscendEX Team

The exchange is managed by three individuals: George Cao (Co-founder and CEO), Ariel Ling (Co-founder and COO), and Shane Molidor (Global Head of Business Development). These individuals have many years of experience in asset management, banking, and finance.

Mobile Support

The majority of cryptocurrency traders believe desktop platforms offer the greatest trading experiences as the computer’s screen is larger allowing traders to access more critical information that they use to make trading decisions all at once. It will also be easier to show the trading chart. Nevertheless, not every cryptocurrency trader needs a desktop, some people would rather trade cryptocurrencies on their phones. For those who are interested, AscendEX’s trading platform currently offers an app for iPhone and Android devices.

Leveraged Trading

Users of AscendEX can also take part in leveraged trading. This indicates that you may purchase cryptocurrency by borrowing funds from the exchange. Depending on the trade, the interest rate may be as low as 3.65% annually (or 0.01% a day). Leveraged trading may result in significant profits but also lead to significant losses.

For example, suppose that you have 10,000 USD in your trading account and you place a 100 USD bet on Bitcoin going long (i.e., increasing in value). You use 100x leverage to do this. If BTC’s value increases by 10%, and you bet 100 USD, you earn 10 USD if you simply hold Bitcoin. As you wager 100 USD using 100x leverage, you have instead made an extra 1,000 USD (or 990 USD more than if you had not leveraged your deal). However, you have lost 1,000 USD (990 USD more than if you had not leveraged your trade) if the value of BTC falls by 10%. There’s probably a lot of potential but there’s also a lot of risk.

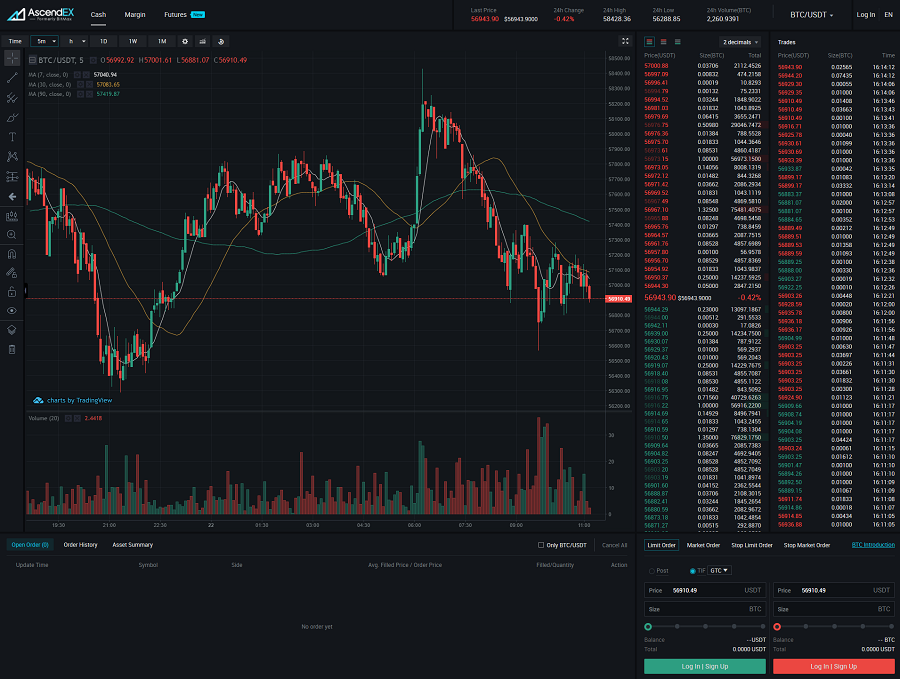

AscendEX Trading View

Every exchange has its own different trading views. There is also no “this overview is the best” belief. It depends on you to decide which trading view is best for you. A price chart of the selected cryptocurrency, order history, the order book or at least a portion of it, are what most trading views have in general. Typically, they also include purchase and sell boxes. Try to look at the trading view before selecting an exchange to make sure it is suitable for you. The trading view at AscendEX is displayed as follows:

AscendEX Fees

-

AscendEX Trading fees

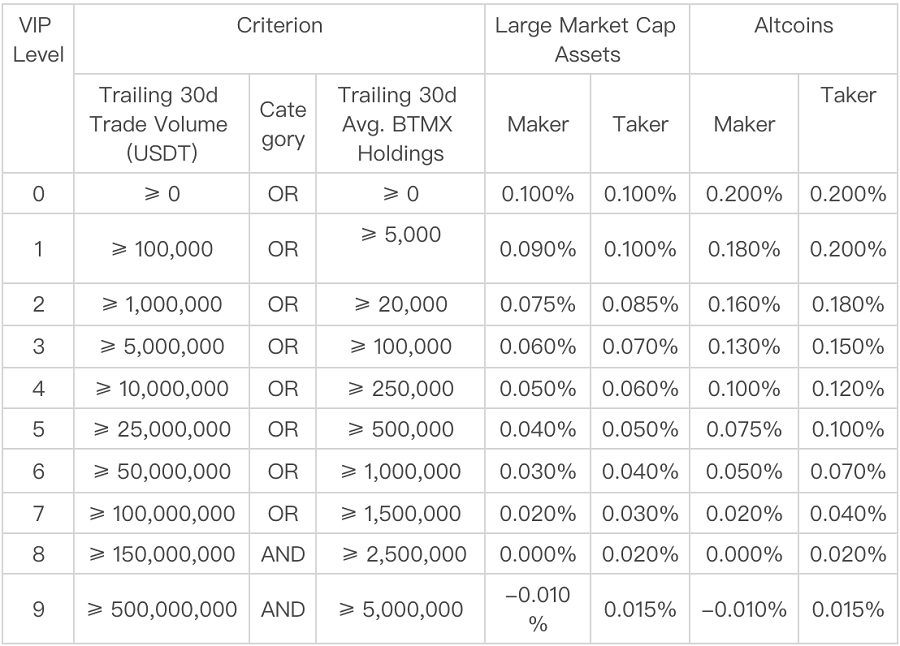

Many exchanges charge their fees based on 2 different types: maker and taker fees. Thus, charging “flat” rates is the main alternative meaning that the exchange charges the taker and the maker the same fee.

The basic fees on this exchange are 0.10% for high market cap assets and 0.20% for “altcoins” for each transaction. 0.10% applies to users with the lowest VIP level (VIP 0). Higher VIP tier users will be qualified for lower trading fees, as further explained in the following image:

For a long time, the industry average was 0.25%, however, many exchanges are currently moving towards lower trading fees (0.05% to 0.15%). AscendEX’s fees are competitive when compared to any other exchanges.

-

AscendEX Withdrawal fees

The withdrawal fee is an additional factor that needs to be taken into account when deciding which exchange to trade. The withdrawal cost tends to be fixed (regardless of the number of cryptocurrency units withdrawn) and differs for each coin. This exchange charges 0.0005 BTC to withdraw BTC, this is less than the industry average of roughly 0.0008 BTC.

All things considered, AscendEX has a completely competitive offering.

Deposit Methods and US-investors

-

Deposit Methods

AscendEX has collaborated with Simplex, a payment processing firm licensed in the EU to offer credit/debit card payment solutions on its platform. As a result, customers can now quickly purchase digital assets using a debit or credit card (Mastercard and VISA allowed). Deposits using Simplex are frequently handled quickly (10-30 minutes), even though there are fees associated with this service. To utilize the Simplex service, you must pay 3.50% of the total deposit amount. The minimum purchase is 50 USD.

-

US traders

Why can’t US citizens open accounts with so many exchanges? The answer is the SEC (the Securities Exchange Commission) because the US governance does not allow foreign companies to solicit US investors unless those foreign companies are registered in the US (with the SEC). The SEC has the right to sue foreign businesses looking for US investors. The SEC has brought legal action against cryptocurrency exchanges several times. One example is EtherDelta for operating an unregistered exchange. Another instance is Bitfinex since they think that investors were being misled by the stablecoin Tether (USDT). There will probably be more examples in the future.

US investors are prohibited from using AscendEX’s exchange. Thus, you will need to go elsewhere if you’re from the United States and want to trade cryptocurrencies. However, you may sort the exchanges according to whether or not they allow US investors by visiting the Exchange List and using exchange filters.

Betomon is a website that reviews, analyzes and knowledge shares about safe and stable financial investment projects on the theme of crypto forex blockchain… Projects to make money online for free

Visit the website betomon.com or register to receive the latest information here.