Sui is a blockchain that is presently receiving a lot of interest, particularly from the developer community. Previously, there were a number of projects converted from other systems to the Sui system, such as Scallop and recently Bluefin Exchange V2. So what is Bluefin Exchange V2 and how can customers use this exchange? Let’s examine the article below to find out with Betomon.

-

Bluefin Exchange: What is it?

Bluefin Exchange V2 is a V2 version of the DEX derivatives platform. Bluefin V1 was previously implemented on the Arbitrum network with a total trading volume of $1B. On October 4, 2023 Bluefin Exchange V2 officially went into operation.

-

Product

2.1. Product

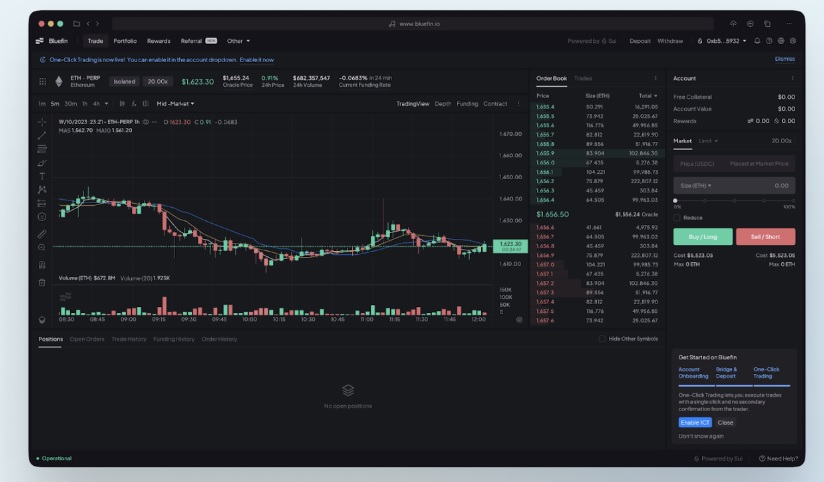

Bluefin allows users to perform perpetual trading with a maximum leverage of 20x. In addition, the daily trading volume on the exchange reaches nearly $100M.

However, at this time, there are several limitations on Bluefin as they allow to use a small number of trading pairs with 4 types of assets such as ETH, BTC, SOL, and SUI.

2.2. Trading fee

The fee structure of Bluefin on Arbitrum and Bluefin V2 on Sui is 0.045% for takers and 0.01% for makers. Fees are measured by USDC and calculated based on the notional value traded. All fees are accumulated into the fee pool.

-

Tokenomics

Updating…

-

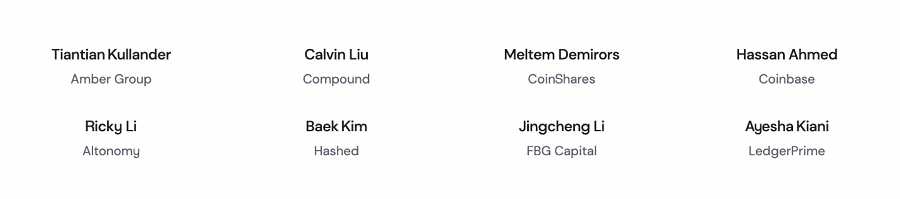

Team

Bluefin is supported by members from large businesses and investment funds including Coinbase, Compound, FGB Capital,…

-

Investor

Bluefin is invested by many significant funds like Polychain Capital, Wintermute, GSR, Parifi, Maven Capital,…

-

Achievement

Since its release in September, Bluefin v2 achieved a number of things as follows:

- Process total trading volume of $2,3B

- Growth in December: average volume of $103M/day, with DEX market share over 80% on Sui.

- Performance: about 550ms with the highest TPS is 5,400+.

- Eliminates wallet: Require only Google account to register and trade on the platform.

- Lower implementation costs: Gas fees are under $0.005 on V2 and fully funded by the Bluefin Foundation currently.

-

Advantages of early Bluefin participation

7.1. Initial trading & earning program

A total of 6% of the BLUE supply will be awarded to users who take part in this program. The event will terminate in March 2024, and a permanent trade incentive scheme will take its place after that.

7.2. Referral program

The referral program will soon be open to all users, allowing them to earn incentives. Additional details on this initiative will be public shortly by Bluefin.

-

Instructions for joining Bluefin v2 on Sui

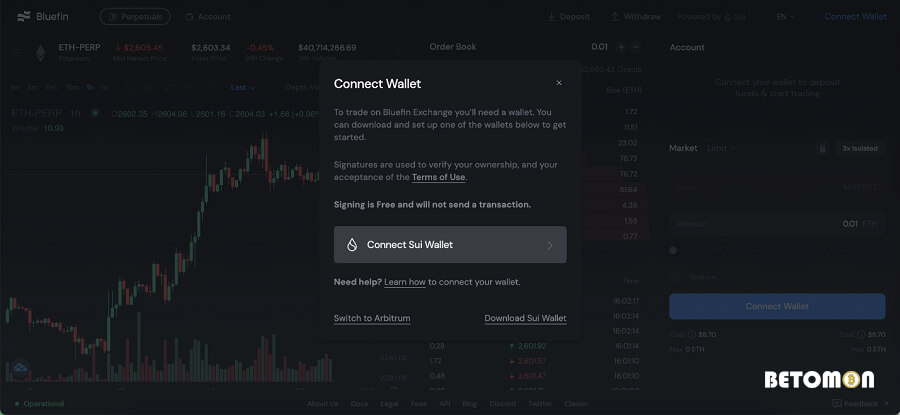

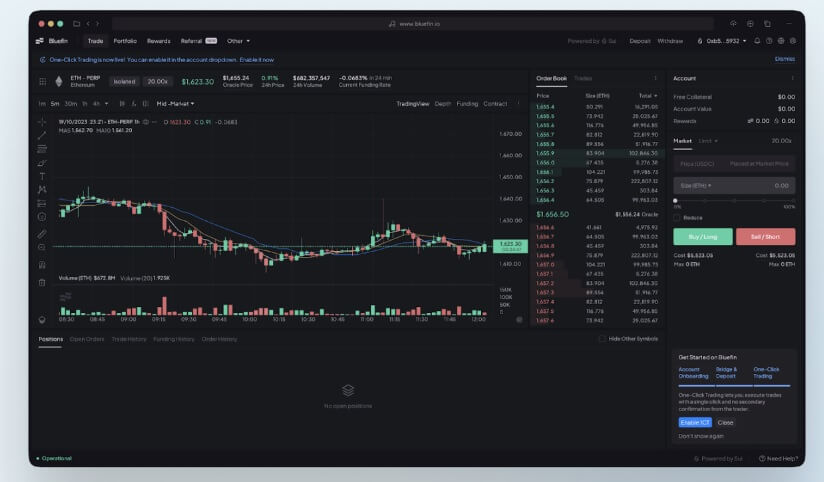

- Step 1: Download Sui wallet. Sui wallet is presently only supported on Chrome-based browsers, and Bluefin v2 officially supports only Sui wallet.

- Step 2: On the Bluefin homepage, click “Connect Wallet” to connect the Sui wallet.

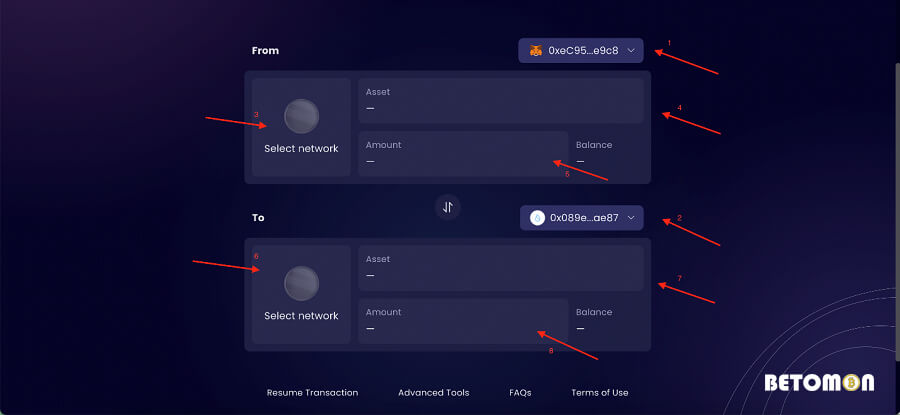

- Step 3: Bridge USDC via Wormhole. First, you have to access this web link: https://portalbridge.com/. In order to bridge, you need to connect to 2 types of wallet: source and destination wallet. For example, I will use the source wallet as Metamask wallet and the destination wallet as Sui wallet. Then follow the instructions below.

When selecting assets in the source wallet, you choose USDC to proceed on with bridging USDC to SUI wallet.

- Step 4: Accept the terms of use of Bluefin

- Step 5: Deposit into your wallet to start trading.

All users who sign up for Bluefin v2 for the first time will get 0.2 SUI in their Sui Wallet to cover the fees associated with transactions as follows:

- Deposit and withdraw USDC

- Delete/Add margin to a position

- Adjust the leverage

The Bluefin Foundation will cover the gas fee for on-chain transactions, so users are not required to pay it.

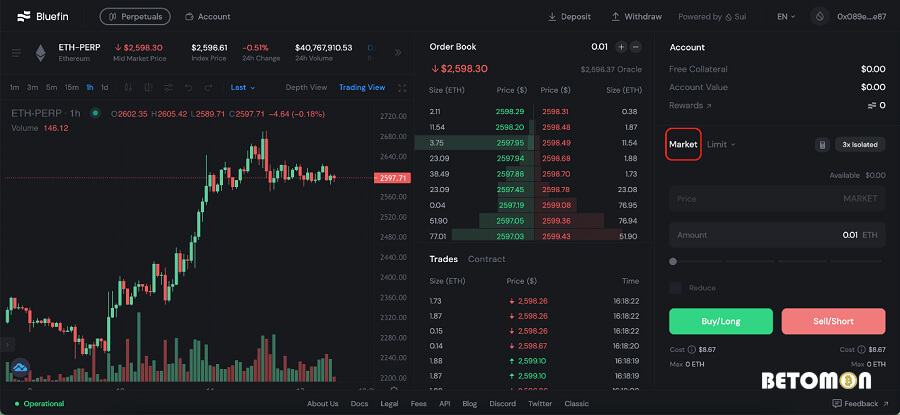

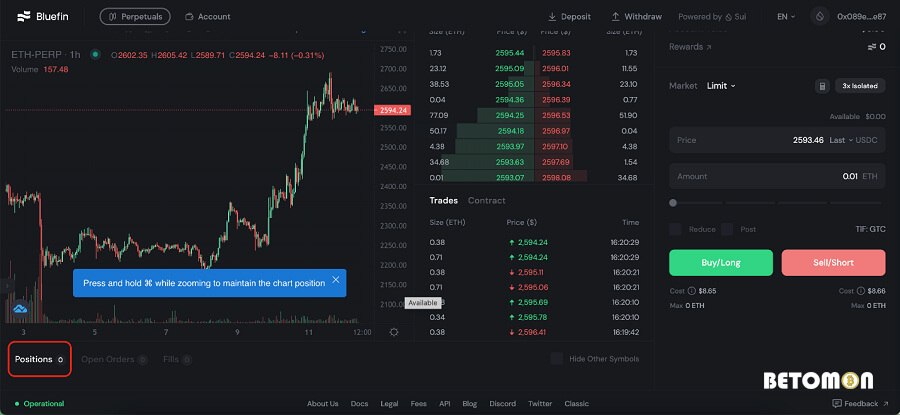

You must select the trading size, leverage, and long or short position before setting up a market order. Depending on whether you choose to purchase or sell, market orders go into effect right away. The execution price is the average price calculated using the number of matched orders.

Limit Order: In addition to quantity, a limit order must also include a limit price. Limit orders may not be executed immediately, it will be posted in the Orderbook and wait for the recipient to fill at the limit price

Whenever your order is fully executed, the position will be displayed in the Positions section below the price chart.

In order to close a position, click on tab “Market” or “Limit”. Next, provide how many positions you want to close in precisely. Additionally, you can check the transaction closing cost and expected PnL here.

You can also close your position manually by selling a long position or buying a short position. Users can only use reduction orders while implementing this manual method.

-

Roadmap

In early February, Bluefin focused on the following activities:

- Account Abstraction: zkLogin, no wallet needed, integrated bridge, 1-click transactions. Users only need a Google account to register and transact

- Upgrade the interface for small users: Redesigning the user interface to make it more friendly for both mobile and web user

The end of March:

- Enhance performance: transaction confirmation within 30 milliseconds, on-chain transaction completion within 550 milliseconds, and the highest TPS is more than 5400 milliseconds.

Bluefin puts an emphasis on improving the user experience for both novice and experienced traders.

The development team plans to wrap up Bluefin Classic shortly and concentrate on bringing additional features and enhancements to Sui.

-

Conclusion

Betomon hopes you found this post about Bluefin useful. As the project has confirmed that it would airdrop to customers upon seeing the product, along with a robust team of advisers and supporters, you might consider to take part in the experience to be able to receive incentives.

If you have any questions, kindly contact Betomon to get the answers.

>>> Instruction for airdrop hunting at Smart Layer

Betomon is a website that reviews, analyzes and knowledge shares about safe and stable financial investment projects on the theme of crypto forex blockchain… Projects to make money online for free

Visit the website betomon.com or register to receive the latest information here.