With cryptocurrencies, there is a whole new meaning to making money by riding the momentum of market trends.

>>> Bybit exchange? Guidelines for using the Bybit exchange

There are many crossover points between traditional and crypto trading. You can learn the principles of trend trading and how they relate to digital assets like Bitcoin in this article.

A New Asset Class and the Repercussions

Since the introduction of Bitcoin on the internet in 2009, a whole new class of assets has appeared. Since then, an exciting new phenomenon has emerged where everyone is willing to try and start trading. Furthermore, social trading emerged as a result of Forex trading, where novice traders could learn from experienced traders. Despite the displeasure of cryptocurrency regulators who are attempting to put the worm back in the can, this movement is now taking root in Bitcoin trading.

Once relegated to the most experienced Wall Street specialists, trade in general has become more decentralized. Trading platforms and a number of cryptocurrency influencers are now increasing the awareness of trend trading.

Definition of Trend Trading

Trend trading is an investing method in which traders use the analysis of the momentum of a certain asset to make their decisions.

This momentum indicates an increase or decrease in the security’s value. Thus, a trend trader might purchase a security when it is going up. On the other hand, they can sell it when going down.

With this kind of approach, there are many methods for determining when to purchase and sell. We’ll discuss it in a moment. Before that, it’s crucial to understand that trend trading involves more than just reacting to charts. Furthermore, it especially relates to cryptocurrency trading.

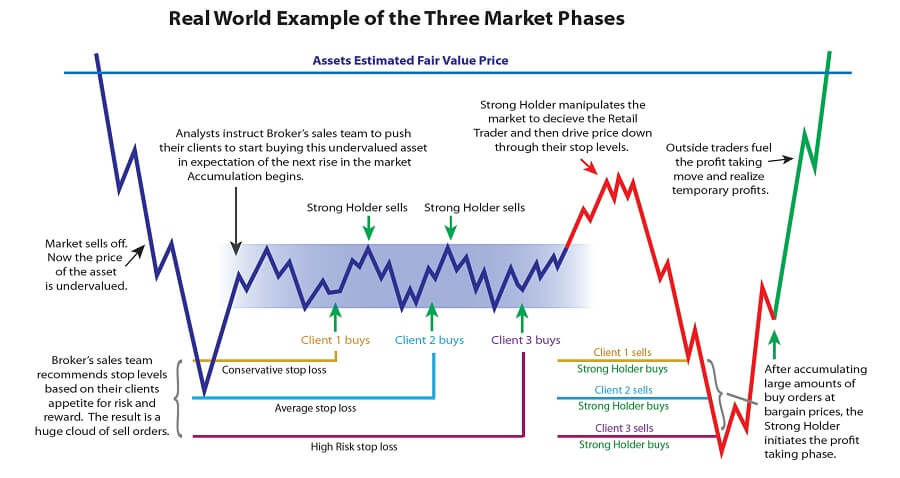

Trends or Market Manipulation?

The cryptocurrency market has little to no regulations, which means there is plenty of potential for manipulation being tried and tested. Therefore, this needs to be taken into account when trading on trends.

It makes sense that a lot of cryptocurrency traders keep up to date on market changes. We will examine the underlying causes of some trends that traders are following later in this article. Because the cryptocurrency market has taught us that there are many factors that affect the determining of the assets’ value.

Trend trading has developed over the past several years rather than just watching for movement signs on charts. All skill levels of cryptocurrency enthusiasts are now attempting to forecast changes. Their news feeds provide plenty of content in this regard. It’s necessary that new traders should make decisions based on data as opposed to emotions by having a good understanding of the basics of trend trading.

What are the Advantages of Trend Trading?

There are the same basic advantages to trend trading, regardless of experience level on Wall Street or level of experience with cryptocurrencies.

- You have the chance to raise your win rate. You might try to earn your profits by using trend trading tools.

- You may have a higher risk to reward ratio. You may have a better chance of choosing the correct times to buy or sell since you are analyzing the movements and histories of a specific security. Purchasing in reaction to FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) makes less sense than doing this.

- Strong trends may be easily identified with the use of trend trading. This reduces the shortcomings of an imperfect set of buy and sell rules. Basically, it is impossible for a trader to always be 100% accurate but using this method might help you get closer.

- Trend trading enables you to be less exact with your entries and exits, yet there’s no assurance that all of your trades will be profitable with this method. This is because you just purchase or sell at that precise moment when you identify a strong trend.

- Almost every market, including futures, commodities, equities, and now, new cryptocurrencies may benefit from trend trading.

All trends will come to an end someday. A trend that is upward will eventually turn downward. This often occurs when security exhibits lower highs (LH) and lower lows (LL). This may be shown clearly in the charts below.

What causes the trend?

Understanding the underlying causes of all these trends that push traders to move is important. Most people believe that most trends are caused by one or more of the following:

- Greed

- Fear

- FOMO (Fear of Missing Out)

- FUD (Fear, Uncertainty, Doubt)

“Market fear and greed are the reasons for trends. Greed increases purchasing pressure, which drives higher prices (an uptrend). Fear generates more selling pressure, which drives lower prices (a downtrend).”

Is Trend Trading a New Phenomenon?

There is currently a steadily increasing number of new traders entering the market. This is mostly because of social trading’s rise and cryptocurrency’s “wow” effect, which among other things, attracts users and provides financial independence.

However, trend trading has been in existence for a while. In reality, Jess Livermore developed himself as the most well-known trend trader in history, making $100 million in 1929 by selling ahead of the market crash.

Trend trading gained prominence thanks to a trend trading experiment conducted in the 1980s by Richard Dennis and Bill Eckhardt. They tested a group of inexperienced traders by showing them how to apply their trend trading approach and then letting them go.

They set out to prove that even beginners could achieve the same level of success as expert traders by applying trend trading techniques. Because they were taught the Turtle trend trading approach, the group of newbies was named the Turtle Traders.

They ended up turning a profit of almost $100 million, incidentally. One of the Turtle Traders’ founders, Richard Dennis, earned $400 million using his strategy in the futures market. As expected, some of the basic instruments of modern trend trading came from the strategies employed by the Turtle Traders.

The Basics of Trend Trading

By paying attention to breakouts between main moving averages, the Turtle Traders produced trade signals. (We’ll discuss moving averages later). They took action by making a purchase or a sell in response to these trade signals, which were generated by looking at stock charts. Multiple techniques, including the use of Technical Indicators, were used to create these analyses both then and now.

Technical Indicators

These are a set of analytical tools for trend traders. Technical indicators are mathematical calculations based on a security’s price, value, and open interest. These indications might be used by a technical analyst in order to forecast price fluctuations. Technical indicators consist of many tools such as Stochastic Oscillators and Moving Averages. Trend traders frequently use multiple indicators.

These (and numerous other) methods allow for unemotional trading. Trend trading is focused on movements and numbers, without regard for human emotions. Bitcoin bots, or automated trading programs, are becoming more and more common in the cryptocurrency industry. Copy trading is another important part of social trading, which focuses on automation. Utilizing our data tools to their fullest potential enables traders to make rational trading decisions.

What are Moving Averages?

Basically, moving averages are technical indicators that use averages to smooth out price fluctuations of an asset. They’re named moving because as time goes, the averages are updating constantly.

This is useful for traders who wish to review historical price history. A moving average cannot forecast quality on its own. The traders will analyze them and use the average data points over time to inform their forecasts.

Traders may notice a signal that the price of an asset has lost momentum by examining moving averages. Alternatively, it can be on a downward trend. The price is now heading below the moving average in this case. In contrast, a price above a moving average is a hint that the security’s prices are likely to rise.

Price fluctuations are not predicted by moving averages. However, they provide you an average price change over time for a certain asset. Thus, they represent a set of instruments for trend traders to analyze the direction and strength of a particular trend.

The Simple Moving Average Explained

Let’s examine the Simple Moving Average, a popular moving average application in trend trading. We use the mean of a given set of variables and use them to calculate this moving average. After that, a chart is created using these numbers for analysis.

Example: If you wanted to review a simple 5-day moving average, you should follow these steps:

- Determine the closing costs of each day

- Add those values

- Divide them by 5 (the number of days)

It would look something like this:

Moving Average Crossovers

Even though a moving average is a line by itself, other moving averages can frequently be overlaid on its own. When two or more moving averages cross over on a chart, this is known as a crossover.

Consider the following situation: you have a long term moving average (100 days) and a short term moving average (5 days). The crossover occurs when the long-term moving average and the short-term moving average line intersect. Usually, it indicates whether to purchase or sell.

Trend Trading Considerations for Crypto

Numerous new players are entering the trading market as a result of the introduction of blockchain technology and hundreds of cryptocurrencies. Additionally, traders with experience in traditional markets are also entering the cryptocurrency space. We now have a new industry with a mix of seasoned traders and novices.

Fortunately, experienced traders are now involved in the cryptocurrency market. They are engaged in activities such as:

- Developing trading strategies that integrate traditional methods with digital assets.

- Producing educational videos to support newcomers in adapting.

- Explaining trading-related subjects in forums and social media.

To sum up

We have just only skimmed on the potential of this exciting and complicated topic. Risk management steps would be a logical next step to study. Hopefully, this post will have provided you with an excellent basis for trend trading knowledge. Certainly, it’s important to offer crypto enthusiasts an alternative to merely responding to simply reacting to news and FUD. On the other hand, this kind of strategy helps to remove the emotion while maximizing the technical tools available to us today.

>>> Top 10 CryptoTraders on Bybit: The Greatest TradingView Chart

Betomon is a website that reviews, analyzes and knowledge shares about safe and stable financial investment projects on the theme of crypto forex blockchain… Projects to make money online for free

Visit the website betomon.com or register to receive the latest information here.