In this article, we will provide you with the Deribit Bitcoin Futures & Options Trading exchange review, an examination of its Safety and Pros & Cons.

Deribit is an international Bitcoin exchange that supports people to participate in futures and options trading.

Deribit, the name of this platform was created by using the first letters from the words Derivates and Bitcoin. Participants may use Bitcoin to make deposits, withdrawals, and collateralize their trading.

Additionally, the platform enables users to trade Bitcoin futures using up to 100x leverage. Despite the fact that Deribit is not as popular as other cryptocurrency futures exchanges, it is attempting to develop itself and become an attractive selection for crypto enthusiasts actively engaged in futures trading.

Deribit Review

Deribit is a derivatives exchange based in the Netherlands, with daily operations in its office in Amsterdam. The project was registered as Deribit B.V. in 2016 and still maintains its address at Stationsstraat 2 B, 3851 NH, Ermelo, The Netherlands.

Along with the interest in Bitcoin and trading, the current CEO, John Jansen and CTO Sebastian Smyczýnski, established the firm and started creating a platform that serves their passions. With lead developer Andrew Yanovsky and CMO Marius Jansen, the Deribit team is among the most transparent in the industry.

Although the platform is transparent, all transactions are performed only in Bitcoin, in addition, Deribit is still operating as an unregulated broker because European regulators have not yet recognized cryptocurrencies as financial instruments and are still working on creating a unified framework.

Nevertheless, the platform is available to users in over 100 nations, supports traders to make deposits and withdrawals without any additional fees, leverages up to 100x, and has competitive trading costs.

Deribit Outstanding Features

- Functionality: Deribit is a web-based trading platform with a user-friendly interface that offers a plethora of functionalities and an intuitive design. Their common features such as the trading history, recent trades and the order book are arranged with clarity. A variety of statistics, technical analysis indicators, futures, index, and volatility charts, and important information about trading in futures and options are also included on this page.

- Technology: The exchange is trying to advance its technology, offering transaction matching with less than 1MS delay. Additionally, traders may trade using the Deribit via the web interface, mobile (iOS/android), or API. Trading bot software like HasOnline, BotVS, and Actant are all integrated with Deribit. Furthermore, the platform uses cold storage to safeguard roughly 95% of customer assets.

- Trading Options: Deribit offers a variety of trading options, including an Options and Futures exchange. The platform specializes in leveraged trading with up to 10x leverage, while BTC futures allow for up to 100x leverage. Users can also use the Deribit testnet to obtain 10 BTC demo funds and practice their trading approaches before engaging in margin trading.

- Customer Support: This trading platform supports many languages such as English, Spanish, Chinese, Russian, Korean, Japanese, and Turkish. A list of email addresses for the support team is included in the members section, they are always available to assist you in any problems. You can also contact them via their Twitter account or Telegram group or reference through their Blog, a Docs page, and an FAQ page in the members section that explains frequent issues. They also operate a YouTube channel in order to provide a number of explanatory videos.

How to Start Trading on Deribit?

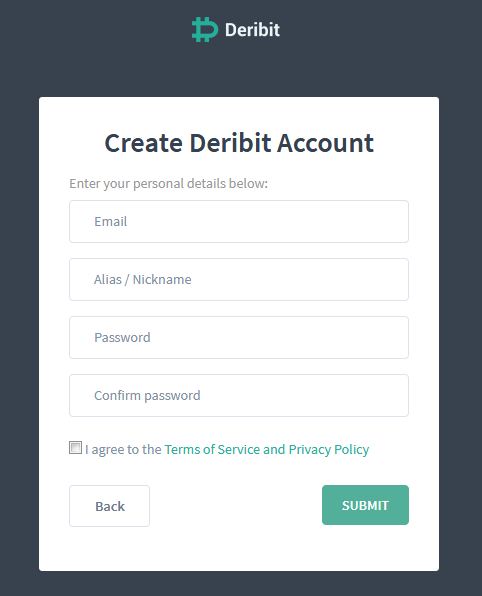

You may start by clicking “Create Account” in the login and registration section in the center of the Deribit website.

1. Create an Account

First, you have to enter your email address, username, password and country of residence to register for an account.

Once you have verified your email address by clicking the link in the confirmation email, you will be able to access your account.

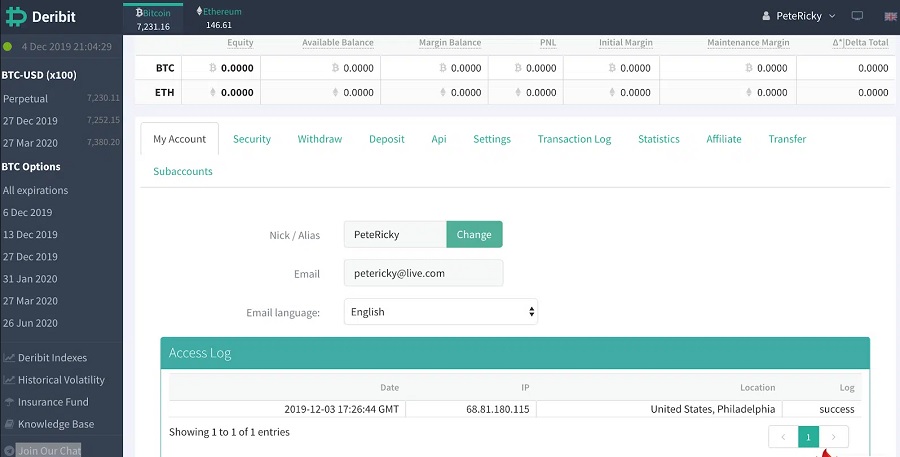

2. Make a Deposit

To fund your account, click the “Deposit” button at the top right of the screen. Next, you need to create a deposit address to deposit Bitcoin into your Deribit account. After you have completed the transfer, Deribit will require only one confirmation before you can start trading.

The withdrawal process is also similar, you may access the “Withdrawal” section from “My Account”. On this page, you need to enter your BTC wallet address and the amount of BTC you want to withdraw. There are several options for priority levels, and the selections correspond to the amount of money you are ready to spend. The higher the priority, the higher the withdrawal charge.

3. Choose BTC Futures or Options Trading

You may choose your favorite trading types by navigating your account. The main selections are on the left side of the dashboard, whereas other key elements are placed in the center.

The futures contracts are quite typical and expire every month. Deribit’s price index is sourced from many leading exchanges, including Bitfinex, Bitstamp, GDAX, Gemini, and Kraken.

Deribit offers future contracts for $10. The order type may be selected from Limit, Market, Stop Market, and Stop Limit using the order panel on the left-hand side.

Investors may reduce the risk by adjusting the Trigger and Stop prices based on their preferred Buy and Sell options. After examining the potential order, click BUY or SELL to confirm it. Confirmed orders will be displayed at the bottom of the screen among all open orders and positions.

In contrast to US-style options, European-style options on the platform cannot be performed before expiration. Click on BTC Options in the top left corner of the screen to access the Options section.

Click on any order that has been listed on the back of the order panel to access the order forms.

The platform offers a live testnet for its users but requires an additional account on test.deribit.com. Users receive 10 BTC in demo money after joining up, which may be used to test different strategies and learn about the platform and the derivatives trading industry in general.

The testnet can also be used to fine-tune bots that will subsequently be used on live accounts via the Deribit API.

Supported Currencies and Fees

Users must deposit Bitcoin into their accounts on Deribit as it specializes in trading Bitcoin futures and options. Fiat deposits are not supported presently, however, many experienced users frequently buy Bitcoin using fiat money on other exchanges like Kraken, Coinbase, and Gemini before transferring it to Deribit.

It doesn’t charge any fees for deposits, but withdrawals will be charged depending on the mining fees of the Bitcoin network.

Additionally, the exchange uses a maker-taker fee model. Orders in the futures, which improve liquidity are refunded 0.02%, while orders that take liquidity are charged to 0.05%. Orders for perpetual contracts, which provide liquidity are refunded with 0.025%, whilst orders that take liquidity are charged 0.075%. The selected fees are as follows:

Perpetual Contracts

- Maker Rebate: 0.025%

- Taker Fee: 0.075%

Futures

- Maker Rebate: 0.02%

- Taker Fee: 0.05%

Options

- 0.04% of underlying value or 0.0004 BTC/option contract

- Fees are not allowed to exceed 12.5% of the price of the option.

Futures liquidations fees

- 0.35%

Perpetual contracts liquidations fees

- 0.375%

Options liquidations trades

- 0.19% of underlying value or 0.0019BTC/options contract,

In the event of both perpetual and futures contract liquidations, the insurance fund receives 0.30% of the fee, and the insurance fund for options liquidations receives 0.15% of the underlying or 0.0015BTC per contract.

Deliveries

Deliveries are charged half the fees of taker orders, therefore:

- Futures: 0.025%

- Perpetual Futures: 0.025%

- Options: 0.02%

Is Deribit Secure?

Approximately 95% of all Bitcoin is stored in cold storage by the team in order to safeguard customer funds. It may cause a delay in the withdrawal process but it helps the platform to remain resilient to hacking efforts.

Additionally, Deribit incorporates two factor authentications (2FA) for better security of user accounts. However, this feature is not automatically activated, it needs to be set up after logging in.

Moreover, IP pinning provides another layer of protection by identifying when an IP address changes during a session and ending it. Users can also modify their session timeouts; for example, they can change the one-week default timeout term for inactivity on an account to just one hour.

Regardless, it is always advisable to only keep assets on an exchange when they are being traded.

Last but not least, Deribit has an insurance fund established to compensate for the losses of bankrupt traders. Though the majority of trader positions should be reduced or closed by the platform’s real-time incremental liquidation system, bankruptcies still happen.

As soon as settlement is completed, the insurance fund permits the withdrawal of profits on unexpired futures. Liquidation order fees maintain the fund, and in the event that it is exhausted, bankruptcies become socialized among the traders. You may see a list of bankruptcies on the “Insurance” page.

Can Beginners Use the Deribit?

Those who are new to the world of cryptocurrency trading may be familiar with signing up for an exchange and trading cryptocurrency for fiat or digital money. Deribit, however, works in the more complex realm of derivatives, thus novices might not find it appropriate.

Furthermore, trading futures and options is best suited for more seasoned traders due to the possibility of margin trading and leveraged transactions, which increase risk.

However, the team has created a live testnet where users may practice trading 10 BTC in demo funds, study different approaches, and gain experience with the interface and other analytical tools, which can be a little complicated.

The team also provides many materials to assist traders in developing their skills. These include a blog, a docs page, a FAQ page in the members section, and a YouTube channel with many instructional videos.

Hence, even if it might not be the best place to start trading, it might be useful for learning about derivatives trading.

Deribit Benefits and Drawbacks

Pros

- Transparent team

- Futures and options trading available

- Competitive trading fees

- No deposit or withdrawal fees

- High leverage offered

Cons

- Not regulated

- All activities are performed in BTC

- No fiat support

- Not beginner friendly

Conclusion

Deribit offers accessibility to the world of futures and options trading and specializes in the trading of Bitcoin derivatives. The platform includes many great features that may help it gain a competitive advantage over its rivals such as BitMEX and Digitex, including low fees, up to 100x leverage, test trading, and an insurance fund. Nevertheless, Bitcoin derivative trading is still relatively new in the market, and only small amounts are exchanged.

Although offering derivatives, Deribit has not yet been regulated according to EU regulations, and beginners may find it challenging to navigate the complex nature of the platform.

Users are always exposed to the volatility of Bitcoin because the platform does not enable payments in other currencies and accounts are operated in Bitcoin. Moreover, the exchange also decided to restrict residents of particular regions. Therefore, the residents of the United States, Canada, and the Netherlands can not use the exchange at this time.

Nonetheless, Deribit offers an excellent alternative to other Bitcoin futures trading platforms and incorporates a wide range of features that draw in more experienced traders.

The platform offers seasoned futures and options traders exactly what they want as well as an extensive variety of analytics, large leverage, and insurance funds to attract them.

Inexperienced traders could benefit more from using IQ Option, a simpler platform that lets users trade Contracts For Difference (CFDs) on cryptocurrencies.

It would be more suitable for someone who lacks experience but is interested in Bitcoin futures trading to examine the videos and research the materials before investing time in a test account.

Deribit is a good choice for Bitcoin derivative traders because of its complex feature collection, however, it is not recommended for beginners.

>> See more articles of betomon.com to learn more about the crypto world

Betomon is a website that reviews, analyzes and knowledge shares about safe and stable financial investment projects on the theme of crypto forex blockchain… Projects to make money online for free

Visit the website betomon.com or register to receive the latest information here.