Sovryn is commonly known as a decentralized derivatives exchange project combining a borrowing/lending platform.

Now, Let’s explore the differences and potential of the project.

You must have heard about Defi on Ethereum, Defi on Solana or Polkadot. In this article, Betomon will introduce to you a Defi on Bitcoin. This is a platform that incorporates lending and borrowing abilities into a decentralized derivatives exchange. To understand the differences and opportunities of the Sovryn project, go through the details on Sovryn below.

What is Sovryn?

Sovryn is a non-custodial and permissionless smart integration system for lending, borrowing and margin trading Bitcoin.

You may exchange between Bitcoin, stablecoins, and other tokenized assets via Sovryn or execute margin trades for Bitcoin with up to 5x leverage as well as lend Bitcoin, tokens, or stablecoins to get interest.

Sovryn is compatible with Ethereum Virtual Machine (EVM), built on the Rootstock Bitcoin sidechain, and verified by Bitcoin PoW miners. Sovryn also offers highly secure, fast transactions and relatively low gas costs (~1).

Outstanding features of Sovryn

Sovryn’s highlight is its implementation of RSK, which is a Layer 2 sidechain of Bitcoin that provides smart contract functionality using Bitcoin as the native asset. RSK may be considered as Ethereum’s Layer 2 solutions such as xDAI or Matic.

Sovryn can take advantage of the inherent security of the Bitcoin network while also benefiting from Layer 2 solutions’ cost-savings and shorter transaction times by utilizing them for the project. RIF is another project that implements RSK’s solution.

What is SOV?

SOV is an official token of the Sovryn project. Here are the main features of the SOV token:

SOV token key metrics

- Token Name: Sovryn.

- Ticker: SOV.

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: Updating…

- Token Type: Governance.

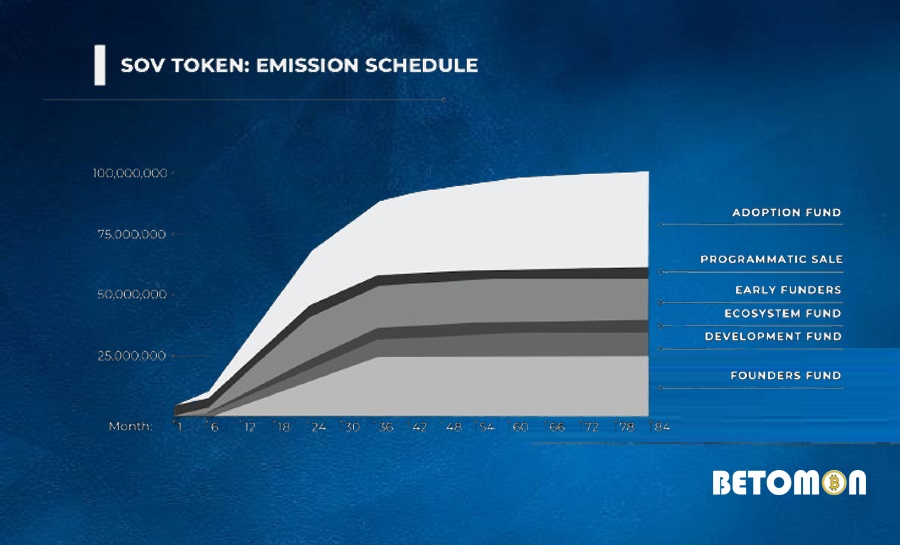

- Total Supply: 100,000,000 SOV.

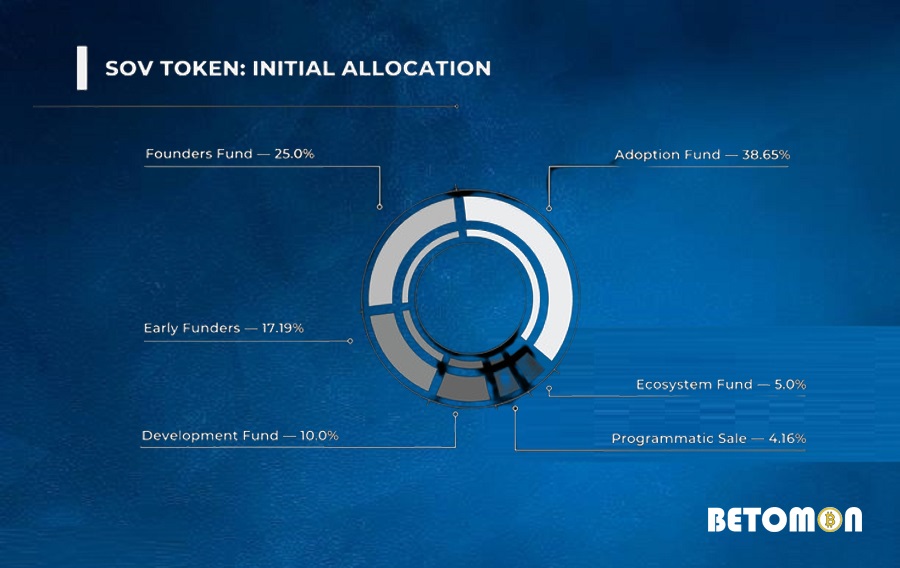

SOV token allocation and its release schedule

Early Funders: 17,194,728 SOV (17.19%) (lock in 10-24 months).

Team and advisors: 25,000,000 SOV (25%).

Development fund: 10,000,000 SOV (10%) to sponsor and reward members with proposals for the future development of Sovryn. This fund will also be used to support security and conduct R&D (Research and Development).

Ecosystem fund: 5,000,000 SOV (5%) committed to user ecosystem initiatives, such as rewards programs to draw in the community or establish relationships with organizations in the cryptocurrency sector.

Sovryn Community Fund: 38,646,017 SOV (38.65%) provided to users and contributors of the system through liquidity mining, referral fees, and rebates.

Token programmatic sale: 4,159,253 SOV (4.16%), the protocol will organize a programmatic sale to distribute extra SOV tokens and attract interested users. Users will have the chance to buy SOV tokens and take part as stakeholders and voters in Sovryn.

SOV token Sale

Over 3,000 Sovryn supporters took part in the first sale, placing orders for a maximum of 0.1 BTC. Because of this, Sovryn was able to raise $10 million at a price of 9,736 satoshi/SOV at that time.

SOV token use case

SOV token supports the following functions:

- Bitocracy: In the Bitocracy system, the voting rights of SOV staked will be determined based on the stake time. Furthermore, individuals who actively participate in governance receive a continuing distribution of the system’s revenue depending on the users’ voting rate.

- Reduce Risk: SOV provides risk insurance for protocol by functioning as a Proof of Stake mechanism that may be burnt, redistributed, or inflated to prevent and offset potential losses.

Platform Usage Fees: Participants of the Sovryn platform can use SOV as a currency to pay fees to perform tasks including swaps, lending, borrowing, and leverage.

How to earn and possess SOV tokens?

At this time, SOV has just been opened for private sale and released in a relatively small amount on the Sovryn platform. Information about a public opening has not yet been disclosed by SOV. Please be cautious if you possess tokens that impersonate Sovryn. Betomon will attempt to provide you with information from Sovryn as soon as they update.

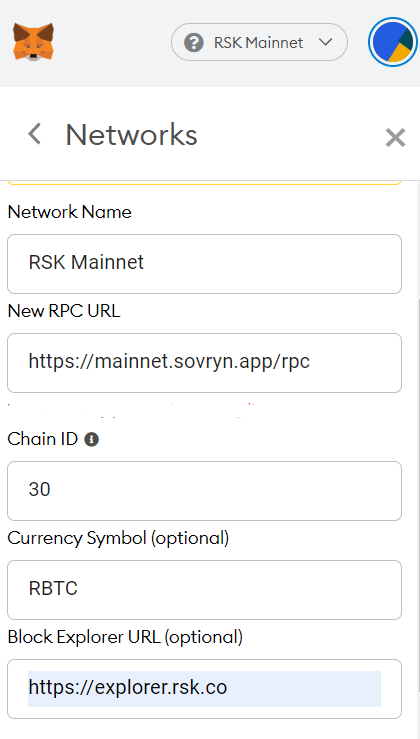

SOV token Storage Wallet

You must convert your Metamask wallet to RSK Network in order to create a wallet for storing SOV Tokens. The installation parameters are as follows:

Network Name – RSK Mainnet.

RPC URL – https://mainnet.sovryn.app/rpc

ChainID – 30

Symbol – RBTC

Block Explorer URL – https://explorer.rsk.co

Next, you access this link: live.sovryn.app, connect to the dApp interface of Sovryn. To activate the wallet, you must deposit a small amount of Bitcoin to the recently created wallet address. Please note that you must fund between 0.001 BTC and 0.01555149 BTC, the fee will be around ~1 for the above task.

Roadmaps & Updates of Sovryn

Phase 0: Completed

Completed the operating mechanisms of the Defi platform (Testnet period) including Spot trading, AMM, collateralized, uncollateralized lending platform, and leverage trading. In addition, the system also developed wallets that can interact with Web3 platforms such as MetaMask.

Phase 1: Completed

Sovryn began the Mainnet launch and received feedback from early users.

Phase 2: Completed

Completed decentralized governance for Sovryn consisting of voting on reward proposals, liquidity mining,…

Phase 3: 1st Quarter of 2021

Launched on the Ethereum Mainnet.

Phase 4: 2nd Quarter of 2021

In addition to launching on Ethereum Mainnet, Sovryn is planning to launch on many other chains or develop Sovryn on Layer 2 of the Ethereum platform.

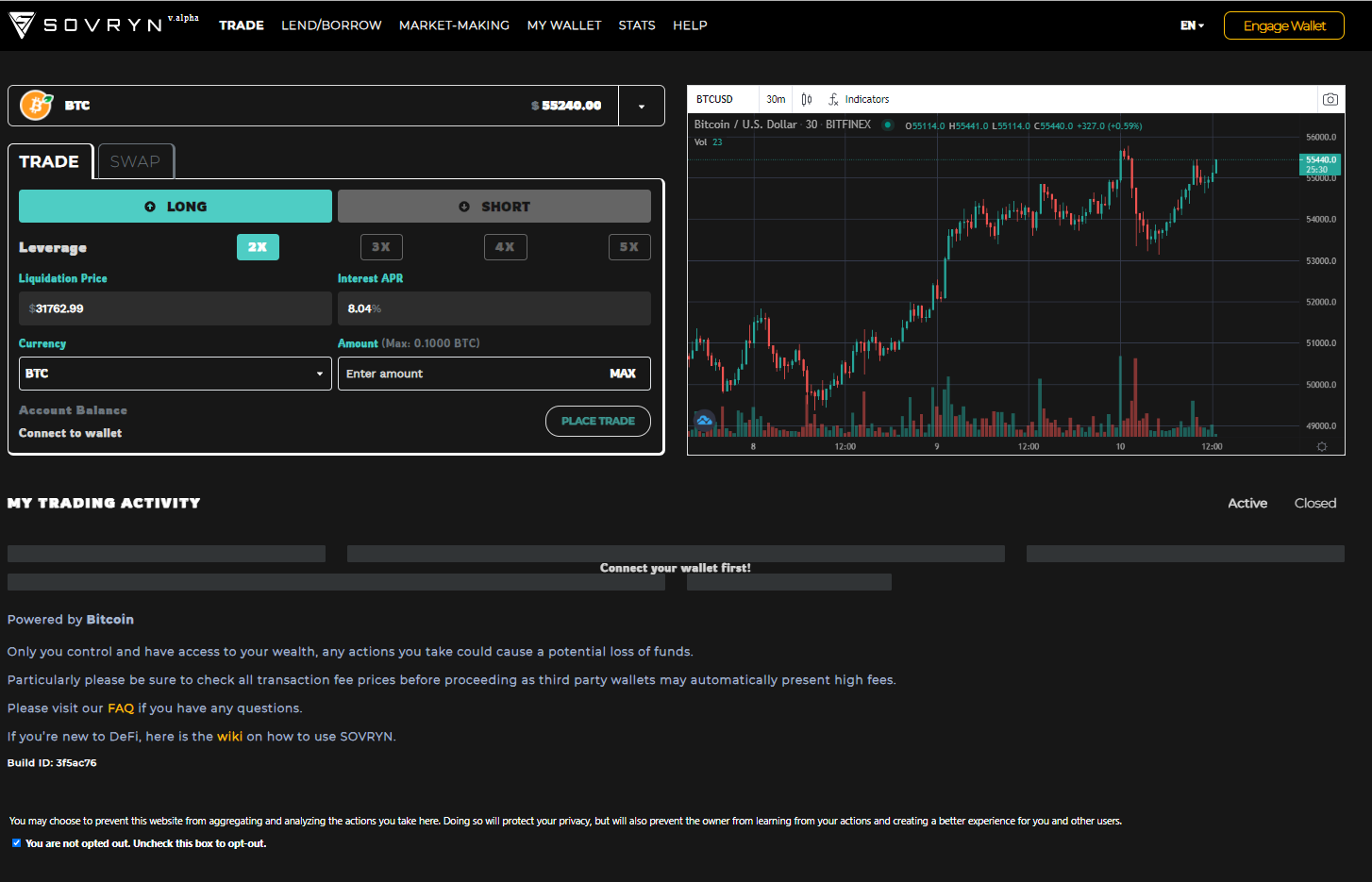

Experience the dApp from Sovryn

Users can presently do the following at Sovryn:

- Spot and leveraged trading: Utilizes an AMM approach with minimal slippage, instant speed, and low fees. Users can leverage up to 5 times while trading. The opening of a position involves a fee of 0.15%, whereas there is no charge for closing one.

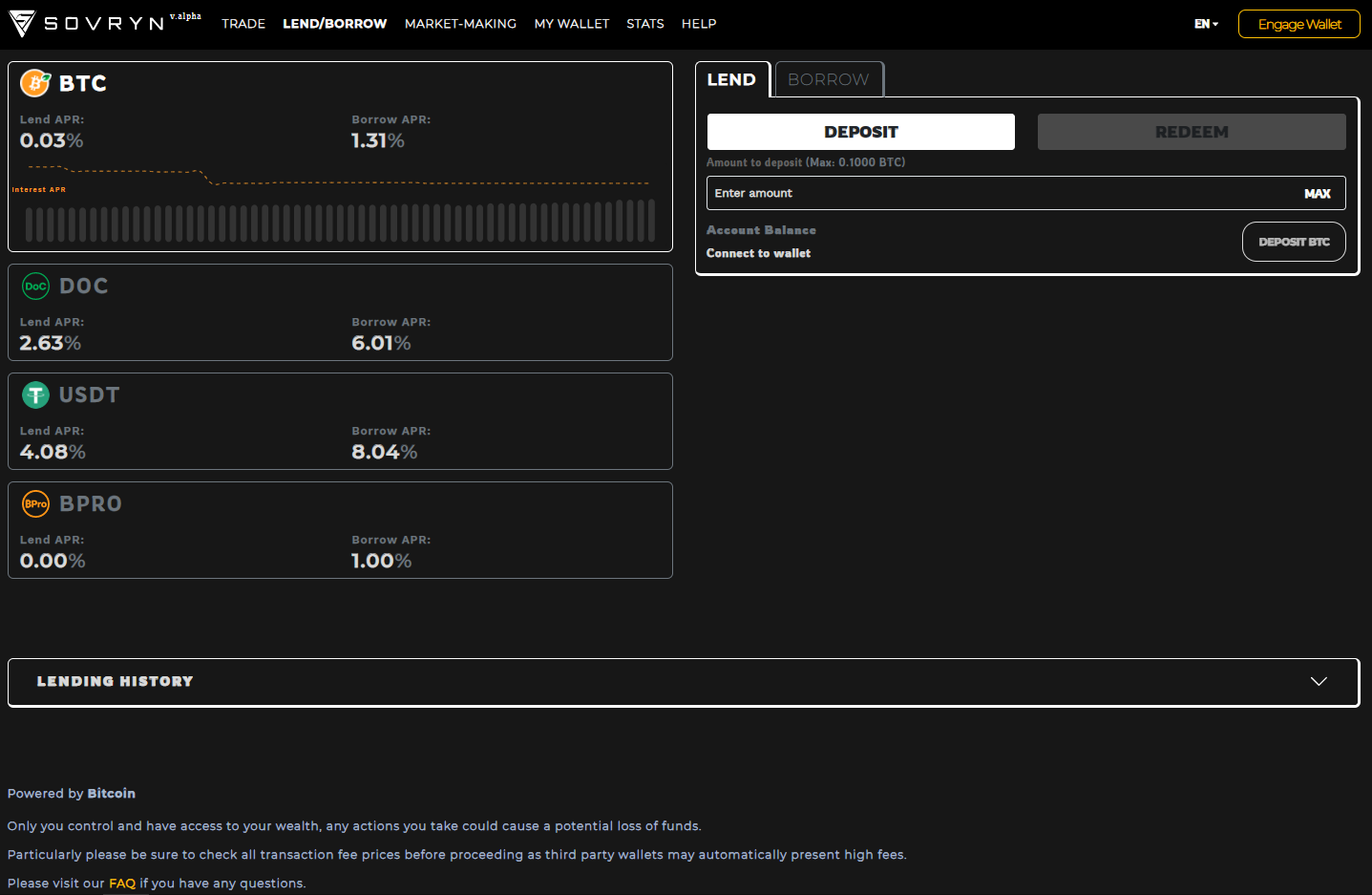

- Lending pool:Enables Bitcoin holders to keep their cryptocurrency while lending for profit. Sovryn will determine the interest rate on the loan at about 10% of the lender’s profit.

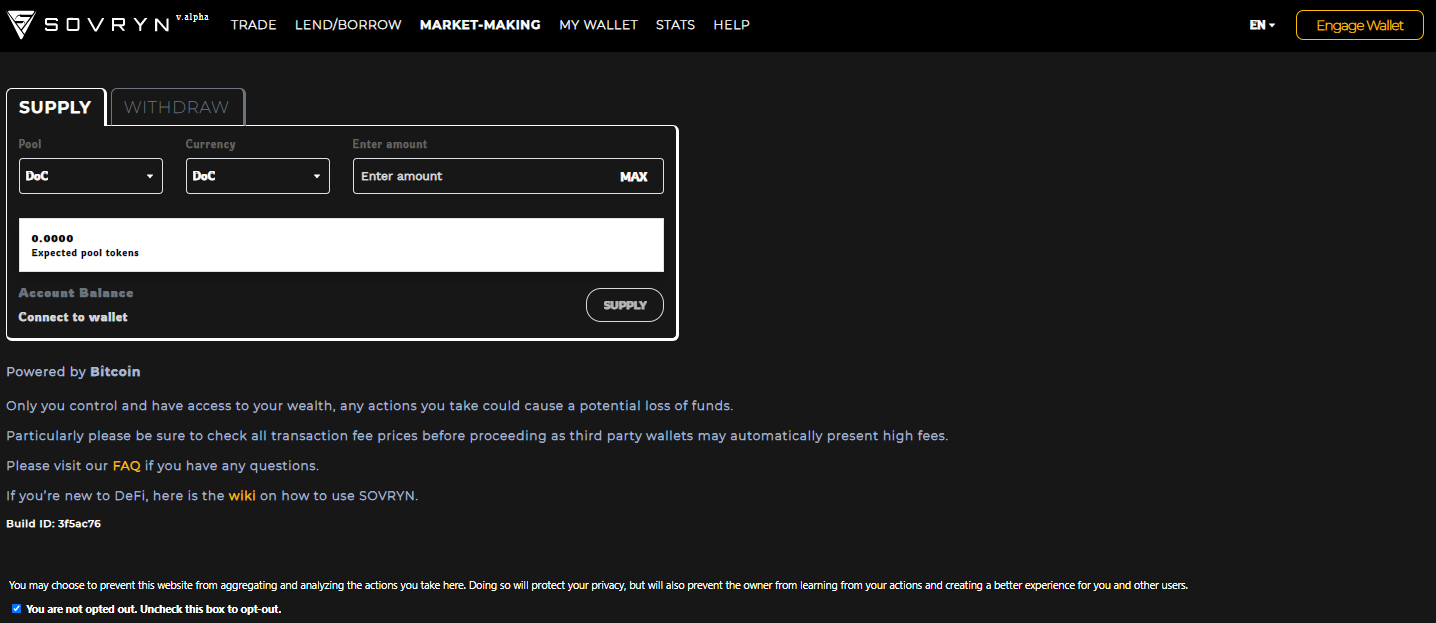

- Market-making: Allows Holder to provide liquidity for the trading platform and receive SOV token rewards.

- FastBTC Relay: Permits traders to utilize Bitcoin almost instantly with smart contracts and decentralized products from any Bitcoin wallet.

In the future, Sovryn will expand the following services:

- Lending: Allows users to borrow tokens using collateral.

- Perpetual Swap:Supports derivatives trading with leverage up to 20x.

- Bitcoin-backed Stablecoin:Users can use tokens calculated in USD and backed by an overcollateralization from Bitcoin.

Development team, Investors and Partners of the Sovryn project

Development team

Sovryn has not published any information about Sovryn’s team yet, however, when there is any information about the team behind the project, Betomon will update immediately.

Investors and Collaborators

Sovryn ecosystem

After the first capital raising with more than $10 million from the SOV token sale to the community, the current total assets of Sovryn are more than $16 million helping Sovryn launch a project to reward white hat hackers up to $1.25 million, discover serious errors related to Sovryn smart contracts.

Sovryn is collaborating with Keep Network, Liqality, tBTC, and RSK (Layer 2 solutions provider on Bitcoin to Sovryn) and invested by Monday Capital, Collider Ventures.

Currently, Sovryn’s smart contract has been audited by Pessimistic (October 2020) and Coinspect (December 2020). This is exciting news for Sovryn users because most dApp platforms encounter many errors in smart contracts, which puts many dApp projects at the target of hackers. Users will feel more secure using a project’s platform if it has passed an inspection.

Other Similar Projects

There are many decentralized derivatives projects like Sovryn in the market, some prominent names include Perpetual Protocol, DerivaDEX.

There is not much distinction among derivatives DEX project. DerivaDEX and dYdX use an order-book mechanism for pricing while FutureSwap and Perpetual Protocol use an AMM (Auto Market Maker) mechanism. Each exchange will provide a distinct leverage level, in which, Perpetual Protocol is offering the widest range of trading assets. However, hardly any project supports the Layer 2 platform, especially the Bitcoin blockchain as Sovryn does.